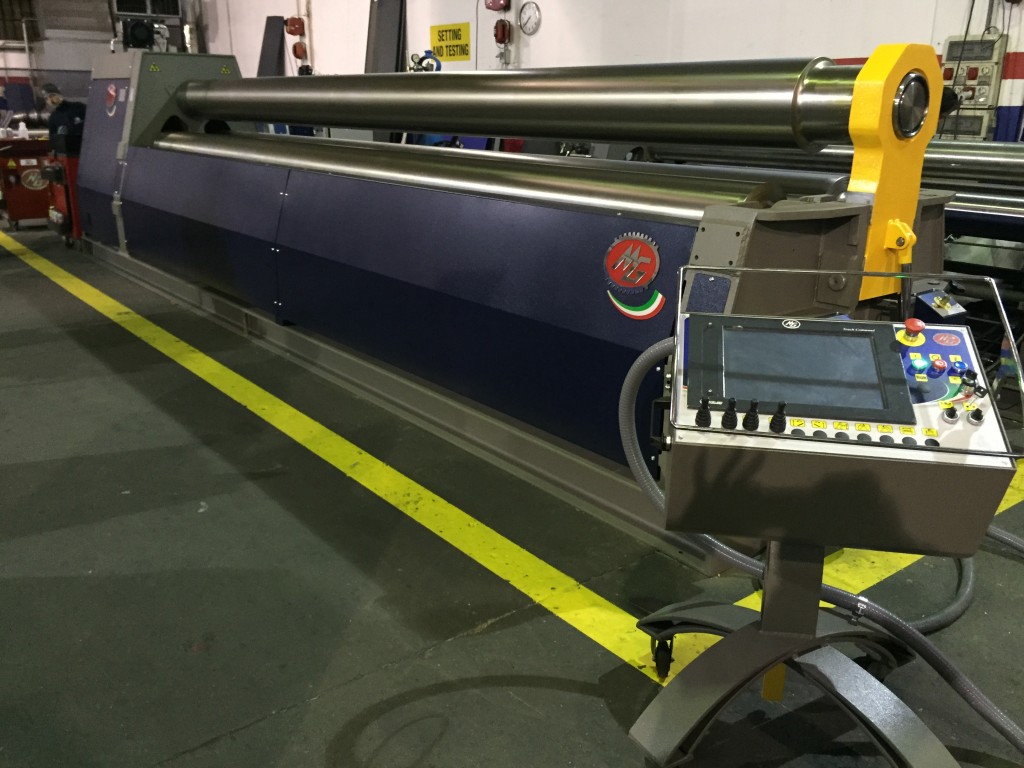

MH814E is one of the longest plate rolls in the world. Shown here with

a) CNC Touch Command EVO

b) Vertical support with double movement

c) Side support

Service providers in the U.S. forecast sales growth will almost double next year to 10 percent, according to a survey by the Institute for Supply Management that also showed manufacturers project increased revenue.

The service industries’ forecast compares with a 5.1 percent sales gain they reported for 2014, the Tempe, Arizona-based group said in its semiannnual business outlook survey today. Purchasing managers at factories anticipate sales will grow 5.6 percent in 2015, up from 3.6 percent for 2014.

A strengthening labor market and the plunge in gasoline prices is giving Americans the ability to keep spending, providing support to manufacturing and service industries. The improvement in demand also bodes well for employment and investment in equipment.

Service providers predicted a 1.7 percent increase in staffing levels in 2015, up from a 1.3 percent gain posted since April. Manufacturers projected a 1.5 percent increase next year, up from a 1.2 percent gain since April.

Purchasing managers in manufacturing plan on increasing capital spending by 3.7 percent in 2015, down from a 14.7 percent gain this year. Service industries plan to increase capital investment by 3.8 percent, versus a 3.3 percent gain this year.

“Our forecast calls for a continuation of growth in 2015, building on the momentum reported in 2014,” Bradley Holcomb, chairman of the group’s factory committee, said in a statement.

Purchasing managers at service industries “are optimistic about continued growth in the first half of 2015 compared to the second half of 2014,” Anthony Nieves, chairman of ISM’s non-manufacturing survey committee, said in the statement.

To contact the reporter on this story: Shobhana Chandra in Washington at schandra1@bloomberg.net

To contact the editors responsible for this story: Carlos Torres at ctorres2@bloomberg.net Mark Rohner

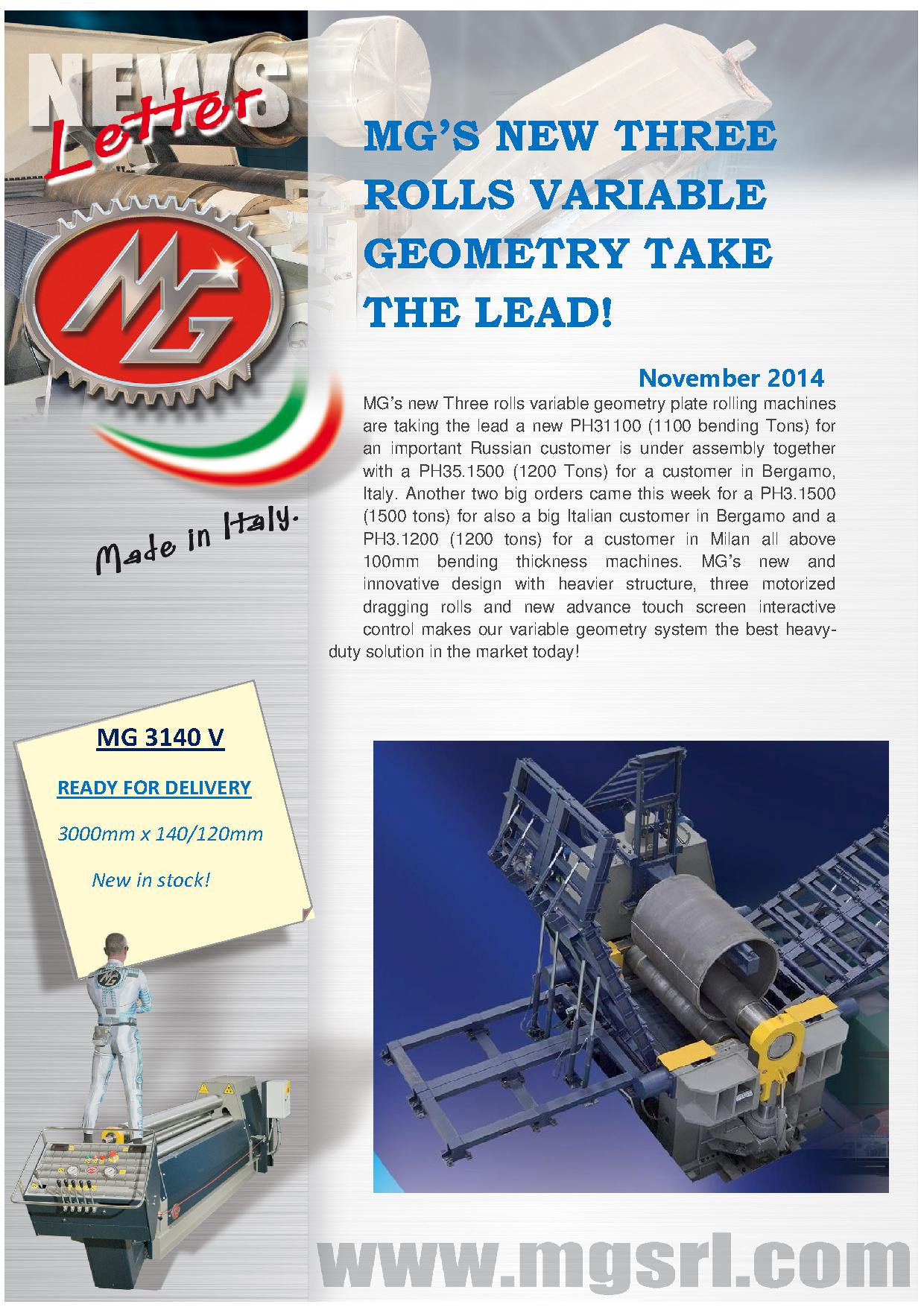

MG’s New Three Rolls Variable Geometry Takes the Lead!

MG’s New Three Rolls Variable Geometry Takes the Lead!

MG’s new three rolls variable geometry plate rolling machines are taking the lead with a new PH31100 (1100 bending tons) for an important Russian customer, together with a PH35.1500 (1200 tons) for a customer in Bergame, Italy.

Another big order came this week for a PH3.1500 (1500 tons) for a big Italian customer in Bergamo and a PH3.1200 (1200 tons) for a customer in Milan. All machines above with a 3.94″ thickness.

MG’s new and innovative design with heavier structure, three motorized dragging rolls and new advanced touch screen interactive control makes our variable geometry system the best heavy-duty solution in the market today!

Click HERE or the picture to the left for a full screen version of the newsletter.

Come talk to our knowledgeable and friendly sales personnel. Ask questions. Pick up brochures. Get ideas.

We are very proud to showcase a newly re-designed M3015C Double Pinch Hydraulic 4-roll Plate Bending Machine M3015C (10′ x 7/8″) with a CNC Touch Command EVO control. Click the link for information on M3015C.

We are offering the “Fabtech Plate Roll” to a great Pre-Fabtech price that you do not want to miss. Please call us for price!

In addition to the show machine we have a fantastic pre-show price on a MH322D Double Pinch Hydraulic 4 Roll Plate Bending Machine with a CNC Touch Command EVO ready to ship FOB Chicago, IL. Click the link for information on the MH322D. Call us for price!

Please take a look at the information below and do not hesitate to contact me should you have any questions.

Email me at cary@cmarshallfab.com or call (805) 416-6982.

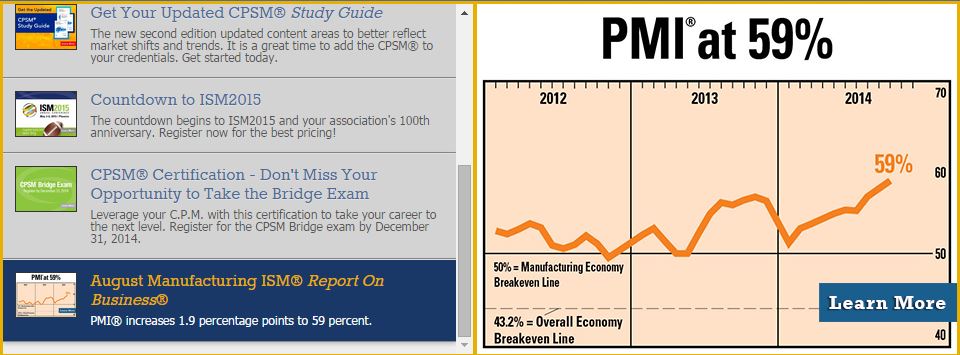

DO NOT CONFUSE THIS NATIONAL REPORT with the various regional purchasing reports released across the country. The national report’s information reflects the entire United States, while the regional reports contain primarily regional data from their local vicinities. Also, the information in the regional reports is not used in calculating the results of the national report. The information compiled in this report is for the month of August 2014.

Tempe, Arizona) — Economic activity in the manufacturing sector expanded in August for the 15th consecutive month, and the overall economy grew for the 63rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “The August PMI® registered 59 percent, an increase of 1.9 percentage points from July’s reading of 57.1 percent, indicating continued expansion in manufacturing. This month’s PMI® reflects the highest reading since March 2011 when the index registered 59.1 percent. The New Orders Index registered 66.7 percent, an increase of 3.3 percentage points from the 63.4 percent reading in July, indicating growth in new orders for the 15th consecutive month. The Production Index registered 64.5 percent, 3.3 percentage points above the July reading of 61.2 percent. The Employment Index grew for the 14th consecutive month, registering 58.1 percent, a slight decrease of 0.1 percentage point below the July reading of 58.2 percent. Inventories of raw materials registered 52 percent, an increase of 3.5 percentage points from the July reading of 48.5 percent, indicating growth in inventories following one month of contraction. The August PMI® is led by the highest recorded New Orders Index since April 2004 when it registered 67.1 percent. At the same time, comments from the panel reflect a positive outlook mixed with caution over global geopolitical unrest.”

Of the 18 manufacturing industries, 17 are reporting growth in August in the following order: Plastics & Rubber Products; Furniture & Related Products; Fabricated Metal Products; Apparel, Leather & Allied Products; Wood Products; Printing & Related Support Activities; Miscellaneous Manufacturing; Paper Products; Petroleum & Coal Products; Food, Beverage & Tobacco Products; Nonmetallic Mineral Products; Chemical Products; Primary Metals; Transportation Equipment; Computer & Electronic Products; Machinery; and Electrical Equipment, Appliances & Components. The only industry reporting contraction in August is Textile Mills.

– “Business is looking good for food manufacturing. Packaging materials prices are staying in check, minimum wage is up a bit, but manageable.” (Food, Beverage & Tobacco Products)

– “The commercial building business is good, our business is up.” (Fabricated Metal Products)

– “Overall business conditions are flat. World issues taking a toll on business. Consumers are cutting back on spending.” (Transportation Equipment)

– “Overall business is improving. Order backlog is increasing. Quotes are increasing. Much more positive outlook in our sector.” (Electrical Equipment, Appliances & Components)

– “Business in the energy sector continues to remain very robust with no signs of backing off in the near future.” (Computer & Electronic Products)

– “Demand in the United States is consistent and geopolitics remain a concern.” (Chemical Products)

– “International markets are slower due to Euro holidays, political unrest and slowing Chinese markets. North American business off slightly.” (Wood Products)

– “Business is strong. Labor is becoming a difficult issue.” (Furniture & Related Products)

– “Demand is strong. Numbers are up over last year.” (Machinery)

– “Strongest month in years. Business is solid…Awesome!” (Primary Metals)

| MANUFACTURING AT A GLANCE AUGUST 2014 |

||||||

|---|---|---|---|---|---|---|

| Index | Series Index Aug |

Series Index Jul |

Percentage Point Change |

Direction | Rate of Change |

Trend* (Months) |

| PMI® | 59.0 | 57.1 | +1.9 | Growing | Faster | 15 |

| New Orders | 66.7 | 63.4 | +3.3 | Growing | Faster | 15 |

| Production | 64.5 | 61.2 | +3.3 | Growing | Faster | 6 |

| Employment | 58.1 | 58.2 | -0.1 | Growing | Slower | 14 |

| Supplier Deliveries | 53.9 | 54.1 | -0.2 | Slowing | Slower | 15 |

| Inventories | 52.0 | 48.5 | +3.5 | Growing | From Contracting | 1 |

| Customers’ Inventories | 49.0 | 43.5 | +5.5 | Too Low | Slower | 33 |

| Prices | 58.0 | 59.5 | -1.5 | Increasing | Slower | 13 |

| Backlog of Orders | 52.5 | 49.5 | +3.0 | Growing | From Contracting | 1 |

| Exports | 55.0 | 53.0 | +2.0 | Growing | Faster | 21 |

| Imports | 56.0 | 52.0 | +4.0 | Growing | Faster | 19 |

| OVERALL ECONOMY | Growing | Faster | 63 | |||

| Manufacturing Sector | Growing | Faster | 15 | |||

Manufacturing ISM® Report On Business® data is seasonally adjusted for New Orders, Production, Employment and Supplier Deliveries indexes.

*Number of months moving in current direction.

Click HERE for the complete report published on September 2, 2014