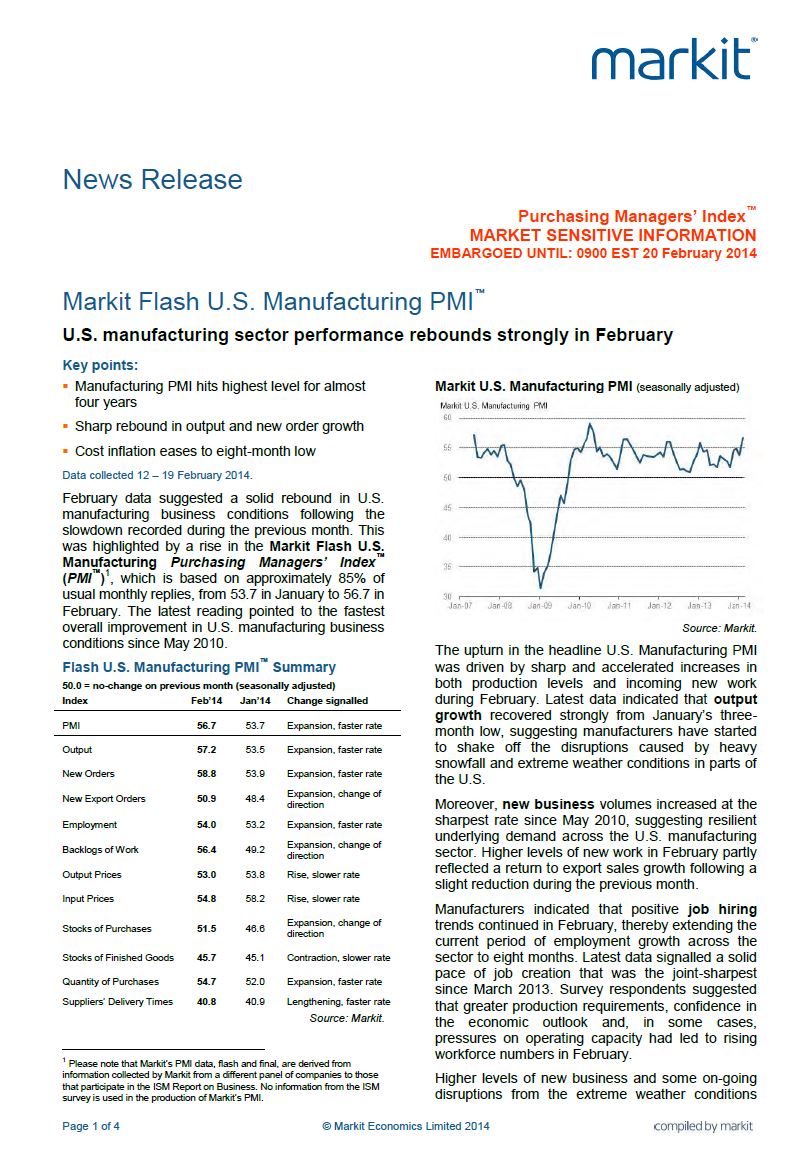

Philly Fed Report Shows Increase In Manufacturing Expansion.

The AP (6/20) reports the Federal Reserve Bank of Philadelphia reported on June 19 that its index of regional factory activity rose to 17.8 in June from 15.4 in May. The figure is the highest in nine months and shows that manufacturing has expanded at a faster pace for the fourth straight month. A reading above zero indicates growth. The report also said that new orders have jumped, suggesting that “production will remain healthy.”

Federal Reserve Revises Growth Estimate.

The New York Times (6/20, Tritch) reports that on June 18, the Federal Reserve announced it was revising downward its yearly forecast for economic growth from 2.3 percent to 2.1 percent. This number is down even further from March predictions in the range of 2.8 to 3.0 percent and lines up with the views of the International Monetary Fund’s estimated growth.

Conference Board Index Gains 0.5 Percent In May.

The AP (6/20) reports the Conference Board said on June 19 that its index of leading indicators predicting the economy’s future health increased 0.5 percent for May. This is the fourth month of increases in the index, and the latest increase represents an improvement from the 0.3 percent gain in April. The index is composed of 10 indicators, and seven of the 10 indicators showed gains for May. The largest negative factor in the index was a drop in applications for building permits. Analysts predict that a growth rebound for the US economy in the second quarter could be as high as 4 percent.

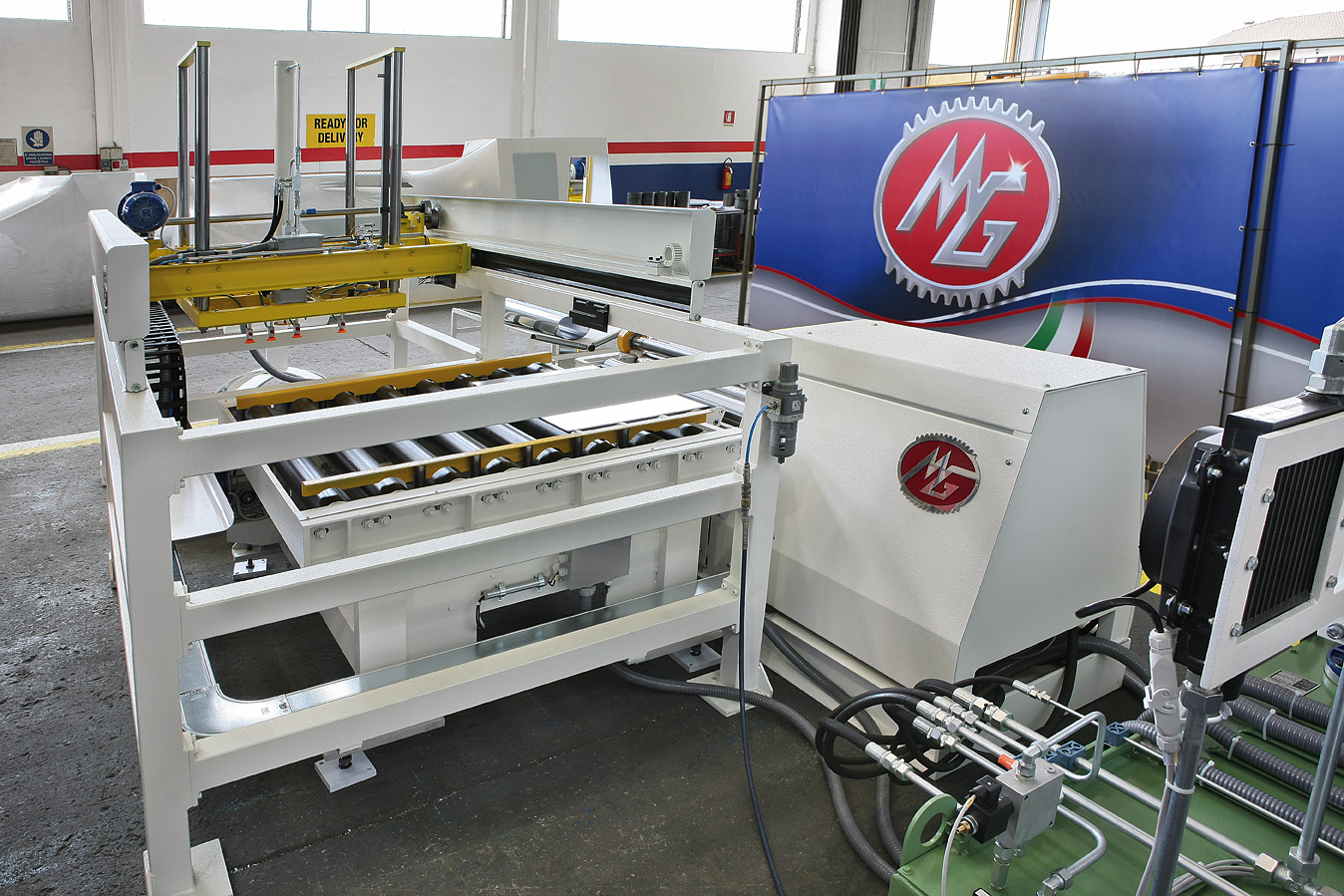

Manufacturing

Report Suggests US Could Add Millions Of Manufacturing Jobs by 2020.

The Christian Science Monitor (6/20, Swan) reports that after losses in the early 2000s, US manufacturing has “started to regain some footing” since 2010, added “more than 600,000 new jobs, according to a new report.” The Administration “celebrated that growth in a series of press events this week as evidence” that the economy is rebounding, but “manufacturing experts suggest that declaration of victory might be premature.” Still, the report, released by the US National Economic Council, suggests that the US could add between 3.5 million and 5 million manufacturing jobs by 2020.

Jobless Claims Down 6,000 Last Week. Bloomberg News (6/20, Woellert) reports that first-time claims for jobless benefits fell 6,000 last week to 312,000, according to data released on Thursday by the Department of Labor. The four-week moving average, which irons out week-to-week volatility, fell 3,750 to 311,750. Bloomberg says that the numbers are “a sign of steady progress in the labor market.”

From SME Daily Executive Briefing June 20, 2014