- Rolling Capacity – 8″

- Pre-bending Capacity – 6-5/16″

- Installed Power – 470 HP

- Top Roll Diameter – 43.6″

- Side Rolls Diameter – 38.6″

- Weight – 473000 lbs

- Bending Force – 3850 tons

No doubt about it, FABTECH 2012 in Las Vegas was an astounding success. The show connected 25,903 attendees and 1,257 exhibiting companies throughout the 465,330 net square feet of exhibit space at the Las Vegas Convention Center. Final details of the event can be found in the 2012 Post Show Report . For those of you who didn’t get a chance to experience the show first-hand, you can preview the show highlights video to see what you missed!

No doubt about it, FABTECH 2012 in Las Vegas was an astounding success. The show connected 25,903 attendees and 1,257 exhibiting companies throughout the 465,330 net square feet of exhibit space at the Las Vegas Convention Center. Final details of the event can be found in the 2012 Post Show Report . For those of you who didn’t get a chance to experience the show first-hand, you can preview the show highlights video to see what you missed!

Manufacturing in the U.S. expanded more than forecast in January, reaching a nine-month high and showing the industry is starting to improve.

The Institute for Supply Management’s manufacturing index climbed to 53.1 last month from December’s 50.2, the Tempe, Arizona-based group’s report showed today. Readings above 50 signal expansion. The figure exceeded the highest estimate in a Bloomberg survey of 86 economists. The median forecast was 50.7.

Stocks extended gains after the report showed gains in orders, production and factory employment after a fourth-quarter acceleration in consumer purchases and a rebound in business spending. The housing recovery and stabilization in overseas markets indicate factories may keep adding to growth in the world’s largest economy this year.

“Manufacturing is on the mend,” said Brian Jones, senior U.S. economist at Societe Generale in New York, who projected a reading of 52. “Things are getting better as we begin the year.”

The Standard & Poor’s 500 Index climbed 0.8 percent to 1,509.7 at 10:47 a.m. in New York.

Another report this morning showed hiring increased in January after accelerating more than previously estimated at the end of 2012, evidence the U.S. labor market was making progress even as lawmakers quarreled over the federal budget.

Payrolls rose 157,000 following a revised 196,000 advance in the prior month and a 247,000 surge in November, Labor Department figures showed today in Washington. The revisions added a total of 127,000 jobs to the employment count in November and December. The jobless rate increased to 7.9 percent from 7.8 percent.

Estimates for the January ISM gauge in the Bloomberg survey ranged from 49.2 to 52.5.

“While we’re off to a great start” to the year, “we just have to see how things materialize,” Bradley Holcomb, chairman of the ISM factory survey, said on a conference call with reporters. “We’re not out of the woods yet.”

Today’s report showed the ISM’s production index increased to 53.6 from 52.6. The new orders measure rose to 53.3, the highest since May, from 49.7.

The employment gauge increased to seven-month high of 54 from 51.9 in the prior month.

The measure of orders waiting to be filled fell to 47.5 from 48.5. The inventory index climbed to 51 from 43. A figure higher than 50 means manufacturers are building stockpiles. A gauge of customer stockpiles rose to 48.5 from 47.

The index of prices paid increased to 56.5 from 55.5.

Manufacturing, which accounts for about 12 percent of the U.S. economy, was at the forefront in the early stages of the recovery that began in June 2009.

Figures yesterday showed the MNI Chicago Report’s business barometer rose to 55.6 in January, the highest since April, after 50 in December, signaling business activity picked up.

Elsewhere, U.K. manufacturing expanded in January for a second month. A gauge of factory activity eased to 50.8 from a revised 51.2 in December, Markit and the Chartered Institute of Purchasing and Supply said in London today.

In the euro-area, manufacturing continued to shrink. Markit’s gauge rose to 47.9 last month from 46.1 in December.

Chinese manufacturing expanded in January, validating the nation’s reluctance to add to policy stimulus amid increasing inflation concern.

The Purchasing Managers’ Index was 50.4 in January compared with 50.6 in December, the National Bureau of Statistics and China Federation of Logistics and Purchasing said today in Beijing as they more than tripled the number of companies surveyed. A separate gauge from HSBC Holdings Plc and Markit Economics covering fewer businesses rose to a two-year high of 52.3 from 51.5.

Earlier this week, a Commerce Department report showed business investment in equipment and software climbed at a 12.4 percent annual rate in the fourth quarter, the best performance in more than a year, after a drop the prior quarter.

Caterpillar Inc. (CAT), the world’s largest maker of construction and mining equipment, is among manufacturers expecting an improving outlook.

“In the United States, we’re becoming increasingly optimistic,” Michael DeWalt, a spokesman for Peoria, Illinois- based Caterpillar, said on a Jan 28 conference call with analysts. “We expect U.S. housing industry to help the economy in 2013.”

An improving housing market is also helping manufacturers such as DuPont Co. (DD), the biggest U.S. chemical maker by market value. Rising demand for plastics used in autos helped the Wilmington, Delaware-based company to report fourth-quarter earnings that exceeded analysts’ estimates. DuPont also said sales in 2013 will climb to $36 billion from $34.8 billion.

“The U.S. is experiencing a weak recovery with bright spots and pent-up demand for housing and autos,” Chief Executive Officer Ellen Kullman said on a Jan. 22 earnings call.

Consumer purchases grew at a 2.2 percent pace in the fourth quarter, up from 1.6 percent in the previous three months, as Americans bought more durable goods including automobiles. A plunge in defense outlays and slower stockpiling led the economy to contract at a 0.1 percent annual pace in the final three months of 2012.

Automobile purchases also may support factory production this year. November-December was the best back-to-back showing for car- and light-truck sales since early 2008, according to Ward’s Automotive Group.

To contact the reporter on this story: Shobhana Chandra in Washington atschandra1@bloomberg.net

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

FABTECH 2012 Confirms: Manufacturing is the Comeback Player of the Year

Record Turnout and Brisk Sales Show that Manufacturing in the U.S. has a Bright Future

The Fabtech trade show, which bills itself as North America’s largest metal forming, fabricating, welding and laser event, is now behind us. 25,903 attendees walked the more than 450,000 net square feet of floor space at the Las Vegas Convention Center. Record first day attendance and solid sales throughout proves manufacturing is not just surviving, but fit and healthy in the US.

FABTECH show co-Manager, John Catalano commented:

“We’ve received great feedback from attendees and exhibitors. Attendees were impressed with the size and scope of the show and the vast array of new products and technologies on display. Exhibitors were enthusiastic and report that sales activity was brisk and leads were plentiful.”

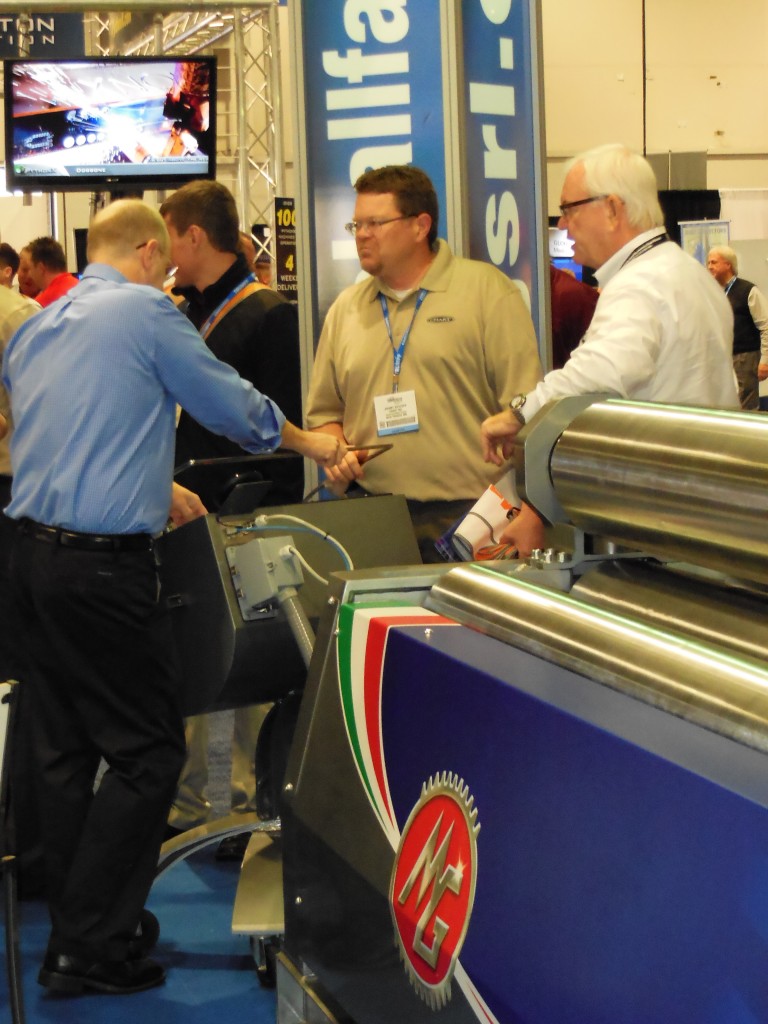

This year we had set up a newly designed booth showcasing a MH314C 4-roll plate roll (10’ x 9/16”). The machine attracted a lot of interest and not just because it was beautifully painted with an American flag on its front but because of what it has “inside”.

The MH314C is the ultimate evolution in the plate bending field with two dragging rolls with hydraulic pinching allowing a steady and precise material dragging. This plate bending machine is the easiest, most versatile, quickest and precise the market can offer.

The machine was already sold prior to arriving to the booth but because of being able to demonstrate it and the CNC Touch Command Control EVO that it was equipped with, we sold several other machines, both MH314C models and other larger models.

We generated more quality leads in Las Vegas than in the last year’s Fabtech Show in Chicago show where the quantity of leads ended up surpassing the quality. This year in Las Vegas we did not have many “tire-kickers” visit our booth but customers that were seriously looking to purchase machines. Discussions were lively and productive.

We generated more quality leads in Las Vegas than in the last year’s Fabtech Show in Chicago show where the quantity of leads ended up surpassing the quality. This year in Las Vegas we did not have many “tire-kickers” visit our booth but customers that were seriously looking to purchase machines. Discussions were lively and productive.

Our overall impression of the show was that there was a genuine belief in the manufacturing business and continued growth in 2013. The optimism could be felt in all conversations.

Now, together with all our fellow-exhibitors we are facing a busy time of following up on the generated leads as well as already looking into the next years Fabtech Show in Chicago. The work never ends!

Cary Marshall next to a MH314C – 10′ x 9/16″ 4-roll plate roll

As the Holiday Season is approaching I wish my customers, vendors, dealers and all the people active in the metal fabrication world a Very Happy Holidays.

Cary Marshall

President

Click HERE for additional pictures from the show.

Who says a machine can’t be beautiful…!? 😀

The pictures are of a MH314C 4-roll plate roll with CNC Touch Command EVO – 10′ x 9/16″.

Welcome to our booth C7716

It is that time of the year again. After months and months of planning, selecting the booth location, budgeting, deciding on what to show, building the booth display, completing forms and ordering services, electrical outlets, carpets, padding etc. and worrying about getting the display machine to the show in time and most of all in perfect condition, we are now finally ready for this year’s show. Almost. Still a few more days to go.

We are very excited and look forward to the show. It is after all North America’s most comprehensive event for metal forming, fabricating, welding and finishing companies. Last year the show that was held in Chicago shattered all records of previous shows, with the number of buyers walking the floor, educational conference attendance and the overall square footage of exhibit space. We hope that we break another record this year.

In our booth C7716 we will showcase a MH314C 10’ x 9/16” 4-roll plate bending machine with full CNC touch command control – EVO. We would love you to come and “test drive” the machine and meet the friendly people from C Marshall Fabrication Machinery, Inc. (CMF) and MG – the factory in Italy that builds our rolls.

MG s.r.l was established in the city of Fossano, Italy in 1959. In 1981 MG began the construction of plate bending machines. Two years later the company concentrated efforts towards a quality production in the field of hydraulic plate bending machines; the original 500 sqm of covered plant surface was extended to the present 4000 sqm on a total area of over 6000 sqm.

MG is today able to answer to almost any kind of demand on plate bending machines manufacturing, and is in condition to propose a large range of models with useful plate length from 20” mm to 28’ and bending thickness capacity from .040” up to 10-1/4”.

The bending machines model MG and MH are the result of a continuous research and innovation in the product engineering and manufacturing, making use of components of the latest technology and innovative solutions. These models are designed and manufactured to obtain a bending capacity equal to 3 times the upper roll diameter with steel plates yield of 36,000.

C Marshall Fabrication Machinery, Inc. is the proud official distributor of MG’s plate rolls in USA.

Below you can see a few pictures of MH314C – the machine that will be showcased in our booth C7716.

The CBS Evening News (10/19, story 5, 0:30, Pelley) reported, “We got a good jobs report today. A Labor Department report shows unemployment fell last month in 41 states, including most of swing states that may decide this election. In Nevada, unemployment has fallen from 13.6% a year ago to 11.8%. It’s still the highest in the nation. In Ohio it’s down from 8.6% to seven, and in Florida unemployment fell from 10.4% to 8.7%.”

The AP (10/19, Rugaber, Pace) reported unemployment “fell last month in nearly all of the battleground states that will determine the presidential winner,” giving President Obama “fresh fodder to argue that voters should stick with him in an election focused squarely on the economy.”

The Wall Street Journal (10/20, Mitchell) reported jobs were added in most of the 41 states where the unemployment rate declined.

The Washington Post (10/20) and Los Angeles Times (10/20, Lifsher, Flores) also covered the story.

From Daily Executive Briefing 10/22/2012

Manufacturing in the Philadelphia region expanded in October for the first time in six months, a sign the industry may be starting to stabilize.

The Federal Reserve Bank of Philadelphia’s general economic index rose to 5.7 from minus 1.9 in September, a report today showed. A reading of zero is the dividing line between expansion and contraction. The median forecast of 61 economists surveyed by Bloomberg was for an increase to 1.

he report, contrasting with data showing New York-area factories shrank for the third straight month, indicates that a pillar of the recovery is starting to regain its footing. Gains in confidence and household wealth mean consumer spendingmay help cushion manufacturing at a time when business investment and exports are hurt by slowing global growth and uncertainty about U.S. tax changes.

“Manufacturing has troughed in terms of the declines in activity,” Russell Price, senior economist at Ameriprise Financial Inc. in Detroit, said before the report. “As the recession in Europe becomes less severe, it will take the pressure off exports. There is some demand” in the U.S.

The Philadelphia Fed’s report covers eastern Pennsylvania, southern New Jersey and Delaware. Estimates in the Bloomberg survey ranged from minus 2.7 to 5.8.

Other reports today showed more Americans than forecast filed applications for unemployment benefits last week,consumer confidence rose to a six-month high and the index of leading indicators climbed more than forecast in September.

Jobless claims increased by 46,000 to 388,000 in the week ended Oct. 13, reflecting an unwinding of adjustments for seasonal swings at the start of a quarter, from a revised 342,000 the prior period that was the lowest since February 2008, according to Labor Department data.

The Bloomberg Consumer Comfort Index rose to minus 34.8 in the week ended Oct. 14, the highest level since April, from minus 38.5 the previous week. The monthly expectationsgauge improved to minus 7 in October, the best reading since May.

The Conference Board’s gauge of the outlook for the next three to six months increased 0.6 percent last month after a revised 0.4 percent drop in August that was bigger than initially reported, the New York-based group said. Economists projected the gauge would climb 0.2 percent, according to the median estimate in a Bloomberg survey.

The Philadelphia Fed’s overall index isn’t composed of the individual measures, one reason some economists consider it a gauge of sentiment among manufacturers. Manufacturing makes up about 12 percent of the U.S. economy.

The breakdown of today’s Philadelphia Fed data was less encouraging than the headline reading. The employment index decreased to minus 10.7, the lowest reading since September 2009, from minus 7.3. The new orders measure dropped to minus 0.6, the fifth contraction in the past six months, from a reading of 1 in September.

The shipments gauge climbed to minus 0.2 from minus 21.2. Its inventory index rose to 2.1 from minus 21.7.

The index of prices paid rose to 19 from 8, while a gauge of prices received increased to 5.4 from minus 0.2.

Factory managers in the region also become less optimistic about the future. The gauge of the outlook for six months from now dropped to 21.6 this month from 41.2 in September.

Figures from the New York Fed on Oct. 15 showed the so- called Empire State index rose to minus 6.2 this month from September’s minus 10.4 reading.

Economists monitor the New York and Philadelphia Fed factory reports for clues about the Institute for Supply Management national figures on manufacturing. The ISM report is due on Nov. 1.

The automobile industry remains a source of growth. Cars and light trucks sold at a 14.9 million annual pace in September, the most since March 2008, according to data from Ward’s Automotive Group. Chrysler Group LLC and General Motors Co. (GM) reported gains.

Businesses restrained by weakening overseas growth include Alcoa Inc. (AA), the largest U.S. aluminum producer. The New York- based company cut its forecast for global consumption of the metal on slowing Chinese demand.

“We do see a slight slowdown in some regions in end- markets, and the main driver for this isChina,” Chairman and Chief Executive Officer Klaus Kleinfeld said on a conference call with analysts this month.

Manufacturing also is stabilizing at the national level, a report showed this week. Industrial production, or output at factories, mines and utilities, rose 0.4 percent in September after a 1.4 percent drop in August that was the biggest since March 2009, according to Fed data issued Oct. 16.

To contact the reporter on this story: Shobhana Chandra in Washington at schandra1@bloomberg.net

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

The nation’s jobless rate dropped to its lowest point in nearly four years in September. And unlike some recent declines, this one happened for the right reason: not because people gave up looking for a job, but because far more people reported having one.

It is a surprising improvement in a job market that had appeared listless in recent months. Although employers added a modest 114,000 jobs in September, the unemployment rate dropped sharply, from 8.1 to 7.8 percent, the government reported Friday.

Unemployment is at its lowest level since President Obama took office in January 2009, offering him a political boost just days after his performance was widely judged as lackluster during a debate against GOP rival Mitt Romney.

The government said hourly wages were up and employees worked more hours in September, meaning they were taking home bigger checks. Overall, the ratio of the American population with a job reached its highest level since May 2010.

The drop in the unemployment rate was bolstered by revisions reflecting that employers had added 86,000 more jobs than previously known in July and August, recasting the troubling summer lull in job creation to a season of solid employment gains.

Although the report offered a brightening picture of the nation’s labor market, the overall rate of job creation remains less than robust. In addition, unemployment remains far above normal levels, and many millions who have jobs are not working full time.

“While the September employment report was more encouraging than the ones we have seen in recent months, the job market is still a long way from rosy, good health,” said Gary Burtless, a Brookings Institution economist.

This year, employers have added only slightly more jobs per month than are needed to keep pace with normal labor-force expansion, and slightly fewer than the 153,000 average monthly gain the nation experienced in 2011. Also, the number of Americans working part-time — even though they want full-time jobs — rose sharply last month to 8.6 million.

With economic growth creeping along after showing signs of more vigorous expansion last year, some economists were skeptical of the magnitude of September’s unemployment decline. A few even predicted that the jobless rate would tick up in the coming months.

“This was a pretty good report, but the drop in the unemployment rate was just too good to be true and probably overstates the degree of improvement in the job market,” said Stuart G. Hoffman, chief economist for PNC Financial Services Group.

Even at 7.8 percent, the joblessness rate remains high by any historical standard. And it could be years before the economy returns to full employment.

But Bernard Baumohl, chief global economist for the Economic Outlook Group, said the dichotomy between the recent steep decline in the jobless rate and the slow economic growth in recent months could mean that the economy is poised to take off.

Economic “growth may turn out to be stronger than most economists currently forecast,” he said. “ . . . Employers are, thus, cautiously turning more optimistic about the economy in 2013 and becoming less apprehensive about hiring.”

Source: Washington Post (10/6, Irwin, Henderson)

Manufacturing unexpectedly expanded in September after three months of contraction, reflecting stronger orders that ease concern the U.S. economy will slow further.

Click image above: Oct. 1 (Bloomberg) — Bloomberg’s Erik Schatzker reports that the Institute for Supply Management’s U.S. factory index rose to 51.5 in September from 49.6 a month earlier. The dividing line between expansion and contraction is 50. He speaks on Bloomberg Television’s “Market Makers.”

The Institute for Supply Management’s factory index rose to 51.5 last month from 49.6 in August, the Tempe, Arizona-based group said today. Readings above 50 show expansion, and the September measure exceeded the most optimistic forecast in a Bloomberg survey.

Stocks extended gains after the figures showed American factories are holding up in contrast to their counterparts inEurope and Asia. Sustained strength in motor vehicle sales and a rebound in demand for home construction materials are helping cushion manufacturers from weaker exports and cutbacks in business investment.

“Housing is definitely supporting,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. “The economy still seems to be expanding, even if modestly, and that should keep overall manufacturing growing.” Still, “it’s hard to see things materially accelerating from here.”

The median forecast in the Bloomberg survey was 49.7, andestimates from the 76 economists surveyed ranged from 48 to 51.2. A reading above 42.6 generally indicates an expansion in the overall economy, the ISM said. The gauge averaged 55.2 in 2011 and 57.3 a year earlier.

Homebuilding outlays climbed 0.9 percent in August, a report from the Commerce Department showed today. A drop in non- residential projects pushed down overall construction spendingby 0.6 percent, the most since July 2011.

Federal Reserve Chairman Ben S. Bernanke today renewed a pledge to sustain record stimulus even after the U.S. expansion gains strength, while saying policy makers don’t expect the economy to remain weak through 2015.

“We expect that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economy strengthens,” Bernanke said in a speech in Indianapolis. Policy makers’ forecast to hold the main interest rate near zero until at least mid-2015 “doesn’t mean that we expect the economy to be weak through” that year.

The Standard & Poor’s 500 Index climbed 0.3 percent to 1,444.49 at the close in New York. Treasuries were little changed with the yield on the benchmark 10-year note at 1.62 percent compared to 1.63 late on Sept. 28.

The ISM’s new orders measure rose to a four-month high of 52.3 from 47.1. The employment index advanced to 54.7 from an almost three-year low of 51.6 the prior month. The gain from August was the biggest since October 2009. The group’s measures of production, export demand, prices paid and order backlogs also climbed in September.

A pickup in new-home construction and stronger auto sales are sources of strength for manufacturing. Housing starts increased in August, reflecting the strongest pace of single- family projects in more than two years, Commerce Department figures showed Sept. 19.

Autos in August sold at a 14.46 million annual rate, the fastest since the surge in August 2009 tied to the government’s “cash-for-clunkers” program. They were up from a 14.05 million pace in July, according to data from Ward’s Automotive Group.

The ISM figures compare with others showing weakness worldwide. In the euro-area, manufacturing contracted for a 14th month in September, suggesting the economy may have struggled to avoid a recession in the third quarter. A gauge of the industry in the 17-nation currency region based on a survey of purchasing managers was 46.1, Markit Economics said today. The index has held for 14 months below 50, indicating contraction, and fell as low as 44 in July.

U.K. factories shrank more than economists forecast and export orders declined for a sixth month. A measure based on a survey of purchasing managers fell to 48.4 from 49.6 in August, Markit Economics and the Chartered Institute of Purchasing and Supply said in London today.

In China, manufacturing contracted for an 11th straight month, increasing pressure on the government to bolster growth in the world’s second-largest economy. The purchasing managers’ index from HSBC Holdings Plc and Markit Economics was at 47.9 last month, compared with 47.6 in August. Export orders declined at the fastest pace in 42 months and factory purchasing activity fell for a fifth consecutive month, the Sept. 29 report showed.

“Manufacturing in the U.S. looks surprisingly good against a backdrop of weak performance in China and the euro area and the looming fiscal cliff,” said Dirk Chlench, head of bond research at Landesbank Baden-Wuerttemberg in Stuttgart, Germany, who had the highest ISM projection, 51.2, in the Bloomberg survey.

Still, some companies, like steel-processor Worthington Industries Inc. (WOR), are tempering their outlook.

“We don’t have a great deal of clarity on where the economy is going,” John McConnell, the Columbus, Ohio-based company’s chairman and chief executive officer, said on a Sept. 27 earnings call. “We’re also not saying that everything’s horrible out there. We’re saying we have some reason to be cautious.”

Caterpillar Inc. (CAT), the world’s biggest construction and mining equipment maker, last week cut its forecast for 2015 earnings after commodity producers reduced capital expenditures. While a global recession remains possible, Caterpillar is forecasting moderate and “anemic” growth through 2015, Chairman and Chief Executive Officer Doug Oberhelman said in a presentation to analysts on Sept. 24.

“We are in no way thinking we’re going to see a recession in 2013,” Oberhelman said. “Europe’s in recession today, probably going be a while to dig out.”

To boost growth and stimulate more hiring that may provide a spark for the economy, the Fed last month said it would keep its target interest rate close to zero until at least mid-2015 and began a third round of stimulus, buying $40 billion in mortgage bonds a month.

“If the outlook for the labor market does not improve substantially, the committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases and employ its other policy tools as appropriate,” the Federal Open Market Committee said Sept. 13 in a statement at the end of a two-day meeting in Washington.

To contact the reporter on this story: Michelle Jamrisko in Washington atmjamrisko@bloomberg.net

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net