WASHINGTON (AP) — Orders to factories rose in December, supported by a rebound in business investment in capital goods. In addition, service companies grew at the fastest pace in 11 months in January as companies started hiring to keep up with rising demand.

WASHINGTON (AP) — Orders to factories rose in December, supported by a rebound in business investment in capital goods. In addition, service companies grew at the fastest pace in 11 months in January as companies started hiring to keep up with rising demand.

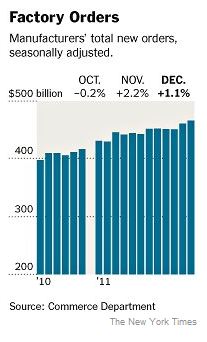

Factory orders rose 1.1 percent in December after gaining 2.2 percent in November, the Commerce Department reported Friday. For the year, total orders were up 12.1 percent after a gain of 12.9 percent in 2010. Orders had plunged 22.1 percent in the 2009.

For December, orders for so-called core capital goods, which are viewed as a good measure of business investment plans, rose 3.1 percent to a record high. That gain was driven in part by a rush by businesses to take advantage of expiring tax breaks.

The advances in 2011 pushed orders for the year up to $5.36 trillion, still slightly below the peak of $5.44 trillion set in 2008.

For December, orders for durable goods, items expected to last at least three years, rose 3 percent, a figure that was unchanged from a preliminary report last week. Orders for nondurable goods slipped 0.4 percent, reflecting declines in petroleum products.

The orders category that signals business investment plans, nonmilitary capital goods excluding aircraft, climbed to a high of $68.9 billion in December.

While some of that surge most likely reflected a rush to order before investment tax breaks expired at the end of last year, many economists say they believe the boom in spending on new equipment will continue even without the tax breaks because there is a large amount of pent-up demand on the part of businesses to modernize their operations.

Separately, the Institute for Supply Management said on Friday that its index of nonmanufacturing activity jumped to 56.8 percent in January from 53 percent in December. The survey’s employment index soared to its highest level since February 2006. Any reading above 50 indicates expansion.

The trade group of purchasing managers surveys businesses, including restaurants, hotels, retailers, financial services firms and construction companies. The service sector employs nine out of 10 American workers.

Nearly every component of the I.S.M. index suggested that business for nonmanufacturing companies was picking up. Companies said business activity, new orders, exports and imports all rose. Inventories shrank more quickly, indicating solid sales, and deliveries from suppliers slowed down.

Economists say the service sector received a boost from strong new orders the previous month. In January, new orders grew for the fourth consecutive month, at the fastest pace since last March.

The report “provides further evidence that the U.S. economy is strengthening,” Paul Dales, senior United States economist at Capital Economics, wrote in a note to clients. But he warned that the economic momentum might fade quickly, as it did after strong starts to 2010 and 2011.

“As the unwinding of the previous fiscal stimulus starts to bite and as global demand falters, something similar may be on the cards this year,” he said.