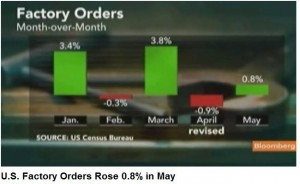

US Factory Orders Rose In May.

Click image to left for video.

Bloomberg News (7/6, Kowalski) reports, “Orders placed with US factories increased in May, indicating manufacturing may rebound from a slowdown in economic growth in the first half of 2011.” The Commerce Department found that “bookings for manufacturers’ goods rose 0.8 percent, less than forecast, after a revised 0.9 percent decline in April that was smaller than previously estimated.” Durable goods demand was up 2.1 percent. According to Bloomberg, “the improvement in orders supports the view of Federal Reserve officials, who last month said the economic slackening likely reflects temporary restraints.”

The AP (7/6, Rugaber) reports that “the jump in factory orders after a sluggish spring suggests supply disruptions stemming from the Japan crisis are fading.” Factory orders reached $445.3 billion overall, which is “almost 32 percent higher than the low point during the recession, reached in March 2009.” The AP notes that “much of the increase was driven by a 36.5 percent increase in orders for aircraft, a volatile category.” However, “there were also signs of strength in areas that had slowed sharply in the previous month,” such as internal company investment.

Reuters (7/6, Mutikani) reports that while durable goods orders were up, inventories for manufactured nondurable goods were somewhat weaker. According to the Wall Street Journal (7/6, Bater, Ackerman, Subscription Publication) the gains were slightly disappointing to economists, who on average had expected a full percentage-point increase in factory orders.

The Hill (7/6, Schroeder) reports in its “On The Money” blog, “The 60 experts surveyed by Bloomberg anticipated new orders would rise on average 1 percent, but there was substantial variance in those projections, ranging from a 0.3 percent decline to a 2.1 percent boost.”

Under the headline “US Factory Orders Lift Recovery Hopes,” the Financial Times (7/5, Kassel, Subscription Publication) reports a more positive take on the news, quoting experts who see strong indications for second-half growth, although they add that the scale of that growth could be modest.

From SME Daily Executive Briefing 7.6.2011