NEW YORK/CHICAGO (Reuters) – U.S. manufacturing companies posted higher-than-expected results, as sharply improved margins boosted profits amid strong industrial demand and growth in emerging markets.

Companies including Catepillar Inc., Tyco International Ltd and Eaton Group reported strong sales and earnings, and investors were looking ahead for signs the industrial rebound would begin to affect the wider economy and boost employment.

Catepillar provided an encouraging sign for U.S. jobs but also showed that employment remains one of the main ways companies can control profit margins.

The machinery maker, which slashed nearly 30,000 full-time and contract jobs worldwide during the recession, said it had rehired about 8,200 workers worldwide in 2010, and hired another 11,000 temporary contract workers, half in the United States.

“A lot of that driven by export demand, so that was an increase in employment,” Caterpillar’s head of investor relations, Mike DeWalt, said on a conference call. “But if you look at sales, sales went up quite a bit more than that.”

Caterpillar’s operating margins jumped from 2 percent a year ago to 10 percent in the fourth quarter. Other large industrial names also expanded margins.

Caterpillar shares were up 1.7 percent at $97.33, an all-time high for the industrial bellwether.

Caterpillar reported a stronger-than-expected quarterly profit, lifted by increased sales of its machines in Asia and Latin America and a sharp rebound in demand in North America, especially from mining customers. The company also forecast it would post a 2011 profit near $6.00 per share, which is above the market consensus.

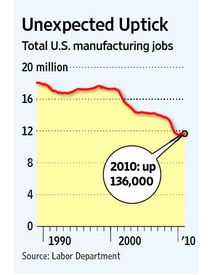

ADDING JOBS

“So far so good,” said Oliver Pursche, president of Gary Goldberg Financial Services, about the earnings season for manufacturing companies. He added that corporate comments on jobs were one of the key factors he was listening for as an investor.

“The more they talk about hiring, the more comfortable we’re going to be with that company. If you’re hiring people, your business is growing.”

Eaton is likely to grow its workforce by a few percentage points this year as markets such as autos, aerospace and non-residential construction recover from recession, the diversified industrial company’s CEO said.

“You’ll see hiring here in the U.S. as well as around the world,” Sandy Cutler told Reuters.

Eaton’s quarterly profit beat expectations on a strong truck market and higher demand for its electrical systems. The maker of hydraulics, truck transmissions and other industrial products forecast record 2011 earnings, set a stock split and announced a 17 percent dividend increase.

Tyco’s quarterly earnings more than doubled, beating Wall Street expectations amid sharply higher profits at the conglomerate’s security business, which includes the former ADT Worldwide service.

Tyco, which said it was close to finalizing acquisitions worth around $500 million, also raised its full-year forecast. Its shares were up 0.8 percent at $45 in afternoon trading. It was one of many stocks trading near multiyear highs.

Industrial shares rose 24 percent last year, lagging only the consumer discretionary sector, according to Standard & Poor’s, which recommends investors stay “overweight” in industrials amid expectations of continued global expansion.

The sector has also outrun the broader stock market in 2011, and a correction could be imminent, S&P said.

As companies keyed to industrial demand continued a trend of beating Wall Street forecasts, investors took profits in some names, like Kennametal Inc. and Timken Co.

Tool maker Kennametal, considered a pure play on industrial production, raised its full-year forecast above Street estimates amid strong demand from industrial and transportation markets. Profit at Timken, maker of bearings and specialty steel, was helped by auto and truck production and an ability to push through higher prices.

Electrical and electronics products maker Hubbell Inc also beat, as did Harsco, which provides products to metals producers.

Conglomerate Danaher Corp. showed sharply higher profits in its industrial components and test-and-measurement segments. It affirmed 2011 earnings targets.

“We expect the global economy to continue to improve in 2011, lead by the emerging markets,” Danaher CEO Larry Culp said on the company’s conference call.

WIDESPREAD OPTIMISM

Optimism among manufacturing executives is widespread. Sixty-three percent are upbeat about U.S. economic prospects over the next 12 months, according to a quarterly survey by PricewaterhouseCoopers. That marked a 28-point increase over the prior quarter.

Still, fewer than half — 48 percent — plan to add employees over the next year, PwC found, partly reflecting concerns about taxes, regulation and soft demand.

Worries about corporate taxes, especially, may keep U.S. companies from significantly boosting capacity until the second half of 2011, said analyst Brian Langenberg of Langenberg & Co. U.S. consumers remain constrained by the housing market.

A reminder that not all is well on the housing front came from the No. 1 homebuilder, DR Horton Inc, which posted a wider-than-expected loss.

“Industrial production is increasing on a global basis,” Langenberg said. “(Manufacturers) need to increase capital spending.

“When do they have to boost capacity? Now. Where? Not necessarily in the U.S.”

(Reporting by Nick Zieminski and James B. Kelleher; Additional reporting by Scott Malone in Boston; Editing by John Wallace, Matthew Lewis, Phil Berlowitz)

By REUTERS

Published: January 27, 2011

Filed at 3:04 p.m. ET