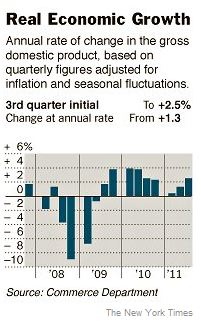

Machinery stocks may outperform the market through the end of the year as new orders rebound, helping to defy concerns about another U.S. recession.

American manufacturers booked $32.6 billion in new orders for machinery equipment in September, the most since July 2008, according to data from the Census Bureau released Oct. 26. The Standard & Poor’s Supercomposite Machinery Index, which includes Caterpillar Inc. (CAT) and Deere & Co. (DE), has gained 26 percent since Oct. 3, while the S&P 500 has risen 13 percent. The machinery index lagged behind between July 7 and Oct. 3, when it fell 35 percent, compared with a 19 percent decline for the S&P index.

“There’s skepticism about the industrial economy and machinery stocks, but robust activity suggests the risk of a double-dip recession is less likely,” said Stephen Volkmann, a New York-based analyst at Jefferies & Co. The sector may continue to rally through December, as it has tended to outperform from November through year-end during the past decade, he added.

There’s “no evidence” of a collapse in North American manufacturing as shipments still are growing, said Ann Duignan, a New York-based analyst at JPMorgan Chase & Co. The total for September was $31.1 billion worth of machinery equipment, up 13 percent from a year ago, Census Bureau data show.

“Companies are still reporting modest growth with no wholesale change in demand,” Duignan said.

Rising Outlook

Parker Hannifin Corp. (PH), based in Cleveland, increased its fiscal 2012 outlook for industrial North American-segment revenue growth to about 8.3 percent from about 6.2 percent, as orders “re-accelerated” during the period ended Sept. 30, said Duignan, who maintains a “neutral” rating on the stock. The motion- and control-technology maker’s orders from the region grew 16 percent compared with a year ago, following an 11 percent rise the previous quarter, the company said Oct. 18.

“There’s a lot of activity,” and “order trends here in North America are still very positive,” President and Chief Executive Officer Donald Washkewicz said on an Oct. 18 conference call.

Caterpillar, based in Peoria, Illinois, reported third- quarter revenue of $15.7 billion, compared with $11.1 billion a year ago, the company said Oct. 24. The construction and agricultural-equipment maker’s order backlog was $24.4 billion, up 40 percent.

“Although there is a good deal of economic and political uncertainty in the world, we are not seeing it much in our business at this point,” Chairman and Chief Executive Officer Doug Oberhelman said in a statement. “This was the best quarter for sales in our history, and our order backlog is at an all- time high.”

Strong Demand

The industry is attracting investors because it supplies “key end-markets,” such as agriculture and energy, where demand remains strong, said Zahid Siddique, associate portfolio manager at Rye, New York-based GAMCO Investors, with holdings in machinery-index members Flowserve Corp. (FLS), Kennametal Inc. (KMT) and Crane Co. (CR)

Machinery companies are a “proxy for global capital expenditures” because almost half their sales come from foreign customers, said Volkmann, who upgraded six of the businesses to “buy” from “hold” last month, including Eaton Corp. (ETN), Cummins Inc. (CMI) and Parker Hannifin.

The recovery in capital spending worldwide is “riding on” the U.S.,China and emerging markets, said David Hensley, director of global economic coordination at JPMorgan in New York. There’s “strong momentum” in these expenditures, which include machinery equipment, even with the European sovereign- debt crisis and this summer’s protracted negotiations between President Barack Obama and Congress over the budget deficit.

‘Continued Expansion’

JPMorgan lowered its growth estimates for Western Europe, reflecting a mild-to-moderate recession that already may be under way; “still, we think growth will continue outside of Europe, supporting continued expansion in capital spending,” Hensley said.

Illinois Tool Works Inc. (ITW), which makes fasteners for transportation and construction products, may be a “sign of things to come” in the region, said Duignan, who rates the stock “neutral.” Its European revenue grew 3.8 percent during the quarter ended Sept. 30, and it predicts “modestly lower” revenue there in the fourth quarter, the Glenview, Illinois- based manufacturer said Oct. 25.

Durable-goods production in Germany fell for the second consecutive month, as a Bundesbank index dropped to 98.7 in September from 99.6 in August. This was “a little weaker than expected, and made me wonder if Europe may be headed in a different direction” from the U.S., Volkmann said.

Unfolding Crisis

The unfolding debt crisis in Europe, possible slowing growth in Asia and any prolonged weakness in the U.S. housing market may threaten outperformance in this industry, said Siddique, whose firm oversees $34 billion in net assets. Even so, companies continue to show resilience as “these risks remain potentially manageable,” he said.

Kennametal — a supplier of cutting tools to Caterpillar and other manufacturers — remained “very bullish” on its outlook as of the quarter ended Sept. 30, Duignan said.

The Latrobe, Pennsylvania-based company “continued to experience growth in customer demand,” President and Chief Executive Officer Carlos Cardoso said on a Oct. 27 conference call. “This supports our continued expectations of a manufacturing-led recovery, at least in the United States.”

To contact the reporter on this story: Anna-Louise Jackson in New York at ajackson36@bloomberg.net

To contact the editor responsible for this story: Anthony Feld at afeld2@bloomberg.net

The

The