More Businesses Seeking Loans, Making Acquisitions.

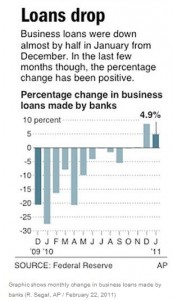

In the last three months of 2010, U.S. Bancorp wrote $8 billion in new business loans, the most in two years. JPMorgan Chase added 400 midsize companies as clients. And bank loans overall grew for the first time in two years, according to the Federal Reserve.

“Companies are talking about growth in ways they haven’t for three years,” says Perry Pelos, head of Wells Fargo’s commercial banking.

Loans are one of the best gauges of economic growth. Small and midsize businesses that form the backbone of the U.S. economy take them out to pay for business needs — unlike big corporations, which go to the bond markets for low-cost debt.

Borrowing by smaller companies is being watched especially closely because it may indicate those companies are preparing to hire. So far, the economic recovery hasn’t been accompanied by job growth. Small companies created about three of every five new jobs over the past two decades.

Those companies took a pummeling during the recession. Bankruptcies skyrocketed and led to massive job cuts. Firms employing fewer than nine people accounted for more than half the jobs lost in the first quarter of 2010, just after the recession technically ended, according to the Labor Department.

Many small businesses blame banks for making matters worse by pulling back credit dramatically after the financial crisis.

Vu Thai, president of Efficient Lighting of Buena Park, Calif., wanted more space to house his energy-efficient light bulbs and fixtures at the end of 2008. “Nobody would lend to us,” Thai says.

But demand for Thai’s bulbs increased, and he snagged Home Depot as a customer last year, sending sales up 10 percent. In December, Thai secured a $100,000 loan to install racks and other equipment in his new warehouse. He bought the space with another loan of $1.6 million taken jointly from Bank of America and a government program for small businesses.

In another hopeful sign, about 75 percent of the loans taken out in the last three months were to pay for mergers and acquisitions. That shows that companies that can afford it are buying up weaker competitors as they prepare for growth in the months ahead.

“After surviving a brutal recession, companies are starting to look around them for opportunities to get stronger,” says Laura Whitley, an executive at Bank of America’s global commercial banking business.

Excerpt from article written by PALLAVI GOGOI AP Business Writer

7:04 a.m. CST, February 22, 2011

Click HERE for full article.